One thing is clear: These aren't your daddy's markets anymore

Why? Because about 10 years ago the Rise of the Machines (aka high frequency trading algorithms) completely altered the terrain of what we call the 'capital markets.'

Let's look at this as a before and after story.

Before the machines, markets were a place that humans with roughly equal information and reflexes set the prices of financial assets by buying and selling. Fundamentals mattered.

After the machines took over, markets became dominated -- in terms of volume, liquidity and pricing -- by machines that operate in time frames of a millionth of a second. The machines and their algorithms use remorseless routines and trickery -- quote stuffing, spoofing, price manipulations -- to 'get their way.'

Fundamentals no longer matter; only endless central bank-supplied liquidity does. Because such machines and their coders are very expensive and require a lot of funding.

The various financial markets are so distorted that I first resorted to putting that word in quotes – “markets" – to signify that they are not at all the same as in the past. In recent years I've taken to putting double quote marks – “"markets"" – in attempt to drive home their gross distortion. Not only are todays “"markets"" something the human traders of a generation ago would fail to recognize, they're no longer a place where human actions of any sort have much of a remaining role.

Why care about this? Two big reasons:

- Such “"markets"" are easily manipulated by central banks and other state actors by virtue of their automated responses to liquidity injections. Are the markets going down when you don't want them to? Just use any one of several highly leveraged means of signaling to the computers that it's time to buy instead of sell. Common leverage points include the Japanese Yen-to-USD price level, selling VIX to lower volatility, and buying massive quantities of index futures 'all at once.'

- These manipulations will work until they don't. When they fail, they may well fail spectacularly -- resulting in shattered markets that have to be shuttered until the damage can be assessed. Investors will not be able to access their capital, either to buy or sell, while things get sorted out. When the markets finally do reopen, valuations will be a whole lot lower due to the loss of the huge block of (phantom) volume previously supplied by the now-shut down algos.

The main predicament were facing is that by jamming the “"markets"" ever higher, the central banks have created an enormous gap between current prices and reality.

An easy to see example of this is the housing market in San Francisco, where average income earners cannot afford average houses -- at all. The only way the SF housing market can re-balance to a sustainable level is either for salaries to shoot up massively (while house prices remain flat) or for house prices to fall.

Equities are no different; their prices current suffer from a similar "reality gap". The same is true for bonds.

Obvious Price Manipulations

Just to show that I'm an equal opportunity critic and don't just think gold and silver are manipulated -- and they have been and continue to be, which is now a matter of fact -- I warn that the same dynamics that infest the precious metals "markets" at the COMEX indeed happen elsewhere.

My conclusion is that the HFT computer algos are in complete control of the "market" action, and play with and off of each other to create massive sudden price movements that have nothing to do with anything except book order saturation.

Today's recent example comes to us courtesy of the WTIC oil market on the NYMEX:

Starting around 6:30am, oil futures started drifting slightly lower. A little volume came in around 6:40 a.m. and then -- BAM! -- right at 6:44 a.m. EST, a super spike of volume to the downside occurred. I happened to be watching this in real time and began counting off seconds. Before I got to 3 seconds it was over. (These are one minute bars so those three seconds are obscured in a full sixty second long bar).

So...8 thousand contracts in 3 seconds. Staggering.

For fun, amortize this out over a full trading year. It's a preposterous figure.

The point being, these volume spikes (especially to the downside) have an intensity that is simply overwhelming for the market structure.

Which is entirely the point of the operation. That's the very essence of price manipulation.

Let's try to look at this rationally. Let's define intensity as "volume of more than 2 standard deviations above the recent 1-hour average, divided by the duration of the volume event."

If we do this, an analysis of the oil chart above would go like this:

Say the average volume was 200 contracts/min. The normal 'intensity value' would be 0, because there are no moments above 2 std before the big volume spike (0/0)

Making a guess of a std of 300 for the normal period, at the height of the spike, the value would be ~7,400. Then divide the 3 second episode (expressed in minutes) and you get 148,000.

So from an intensity value of 0, thing spiked up to 148,000 in a matter of seconds.

Is that a useful number or way to look at this? I think so, because it expresses the idea that these volume spikes, combined with their extremely short duration, have an intensity that is far outside of the normal trading bounds. And it's that super out-of-range characteristic that just clobbers the price of whatever is being traded (in this case oil, one of the most widely-traded commodities on the planet).

These blasts destroy the market bid/ask structure in those moments. You have literally zero chance of trading that event as a human, even and especially if using 'insurance' like stops.

This means that the "markets" have a barrier to entry where the cost is the price of a very expensive arrangement of hardware and software capable of operating at the micro-second level. Humans need not apply.

These are not your daddy's markets. They belong to the big players (aka big banks and hedge funds) and their very expensive machines.

Understanding Volume vs. Liquidity

What we're really describing here is a sudden spike in volume that basically destroys the current market book of orders.

What that means is this. Imagine that you are selling eggs at the farmers market along with nine other vendors. There are 500 people wandering the market looking for eggs and other produce. The average sales rate for all 10 egg vendors and all 500 customers is 5 dozen eggs per minute.

The price you can sell your eggs for is set in accordance with the other prices around you. Yours are organic, but small. The vendor next to you has large eggs that are conventional, but larger. And third has small colored eggs from heritage breeds that are free range. Let's say that the range of selling prices is from $4/doz to $5.50 per dozen. This is the market structure for eggs at our farmers market in this thought exercise.

All of a sudden, a giant semi-truck backs up. It's filled with eggs matching every description of those being sold at our small little market. A bullhorn speaker rises from the roof of the truck and announces that 10,000 dozen eggs are now available for the next 1 minute for whatever price anyone is willing to give him for them.

What do you think happens to egg prices over that one-minute window? That's right, the price gets completely crushed. And what do you think happens to demand for eggs among the 500 potential customers at our market? It's completely satisfied. So future demand is eliminated and sales volumes decline accordingly.

In other words, the “"market"" for eggs got ruined, right there and in an instant. You and the other 9 original egg merchants got thoroughly hosed.

The volume of eggs on offer shot up massively all of a sudden, but once all 500 potential egg buyers had been satisfied, the number of buyers dropped away rapidly. Liquidity dried up.

This shows how it's possible to have a market with tons of volume, but no liquidity. There are lots and lots of eggs for sale, but no buyers. All volume, no liquidity.

I know this is a little complex, and possibly arcane, but the points are important to understand. You see, even the most liquid of all possible markets, the US Treasury market, er “"market"", suffered an amazing flash crash back in 2014. It's been pretty well studied, but the culprits were the HTF machines that now dominate that “"market.""

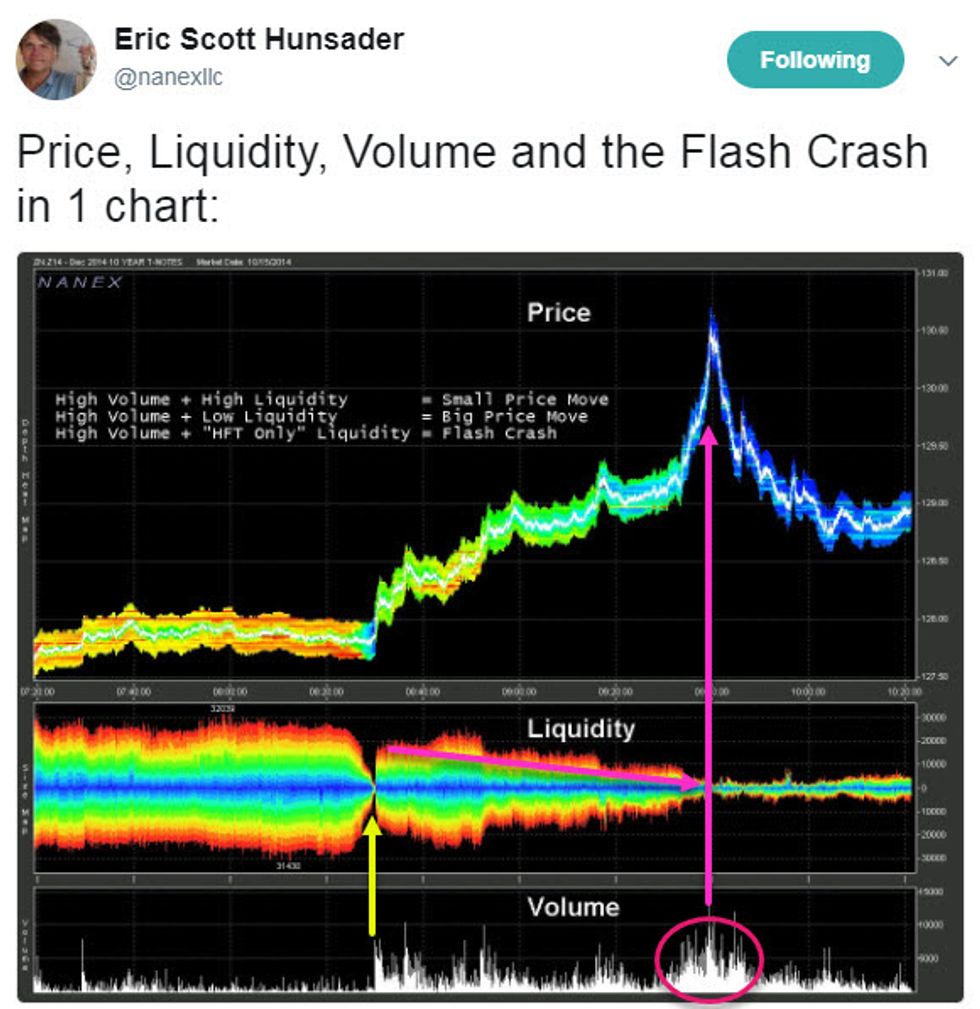

This next chart by Eric Hunsader of NANEX (whom we've interviewed numerous times over the past years) shows the relationship between price, liquidity and volume on that fateful day, when yields plunged and prices spiked (remember in bonds yield and price move oppositely).

Note the first event which was a sudden loss of liquidity, seen at the yellow arrow:

Price, Liquidity, Volume and the Flash Crash in 1 chart: https://t.co/jo5LRnPVjd— Eric Scott Hunsader (@Eric Scott Hunsader) 1475843693.0

At the same time that the liquidity dried up, you can see volume ticked up pretty strongly and this caused prices to rise. For whatever reason, in HFT land the rules seem to be:

- High Volume + High Liquidity = small price movements

- High Volume + Low Liquidity = big price movements

- High Volume + HFT only Liquidity = flash crash

The point here is this: The computer bots now are the market.

They operate according to a set of pre-programmed parameters. If or when those parameters are exceeded, they simply vanish in less than an eye blink. When that happens, prices go wonky as the remaining few algos go wild. Their resulting erratic trading spikes volumes and prices all over the place.

Why This Matters

Maybe you're thinking, “So what?" Maybe you aren't a trader and think the hows, whens and whys of the computer algos in the Brave New Market isn't really of any concern to you.

But it really is. And here's why.

The flash crash in May 2010 gave us an indication, but the mini flash crashes we see almost daily in various other markets -- ranging from the tiny to the US Treasury market -- tell us that it's entirely possible that someday all the worlds computer algos might suddenly stop operating because an event occurs that is out of their programmed operating state.

We've seen these flash crashes numerous times. The biggies were the 1,000+ point plunge in the Dow on May 6, 2010, the Treasury flash crash of October 15, 2014, the ETF flash crash of August 24th 2015, and the dollar flash crash on the last trading day of 2016.

There have been innumerable smaller flash crashes in specific equities and commodity contracts as well. But the biggies show us that nothing is safe. When you can have flash crashes in the entire equity market index universe, ETFs, the Treasury market, and even the US Dollar, then you know there's no safe place.

Everything is under the control of the computers.

A long-running discussion between Dave Fairtex, myself and others, concerns the idea of whether or not markets as big as the ones just mentioned can be manipulated by government/central banking forces to stop, limit, or even reverse a price decline.

My view has always been “yes", because it should be child's play to fool the algos into going this way instead of that way by simply injecting a relatively small amount of capital at the right place and time.

I would love to know, for example, why central banks have an incentive program at the CME -- where the exact sorts of highly leveraged, electronically traded products that would be best suited for market manipulation -- are traded.

By virtue of its existence, we know that central banks are highly active traders on the CME platforms. Otherwise an incentive program offering steep volume-based trading discounts would not exist.

Not one single central bank (yet) reports anywhere in their financial disclosures of being the proud owners of any of the accounts traded on the CME. So the details of the situation remain a mystery.

But dependably, every single market decline that began over the past several years has been reversed -- usually in the dead of night, and in the futures market -- by mysterious injections of capital that then get the HFT algos to follow the trend. So inquiring minds would like to know.

Back to the story: Dave had an opportunity to meet recently with a super smart HFT developer and operator who confirmed that algos are easy targets for such a manipulation scheme should the central banks wish to engage in such a thing.

So I went off to my afternoon meeting with the HFT trading guru and, well, because of too many ciders I forgot most of the questions. But the one I remembered most clearly did get answered.

I asked him, "Do you think that someone could manipulate the market by figuring out what the bots were coded to trigger on, and then taking action to encourage them to do just that?"

Short answer: yes.

(Source)

So, yes, such a thing is possible. And because it's possible, and there are seemingly no consequences for getting caught, and because the Fed is fighting any sort of audit tooth and nail, and because the CME has a central bank incentive program, and because the “"market"" mysteriously self-corrects at odd moments usualy with a flood of intense futures buying, my inner prosecutor thinks he could win a case in front of a reasonable jury here.

The big issue, however, is what might happen if (or rather when) things get 'out of hand' and the computer bots cannot be cajoled back into the market because the parameters are just too far out of whack. 'A major market accident' is the likely answer.

Dave continues:

Two weeks ago I went to this lecture by a guy (a physics PhD) on unsupervised machine learning techniques called "reinforcement learning". In the past, the lecturer had worked for JP Morgan and others on HFT applications. He's now got this startup, and he was (more or less) recruiting AI/ML people to come work for him.

The sense I got from his lecture is that there was a big initial move using machine learning to harvest pennies, but that the market is very efficient now at that particular thing, and so its tough to make a living these days by using that approach. Another thing he said was that, there are bots out there that try to find your bots, and then trick them into losing money. Enemy bots, as it were.

One interesting question was asked by an audience member: "how do you train your bots for market problems or exceptional conditions?" His answer, informed by years of work in constructing market maker bots, was: "the vast majority of time is spent in 'normal markets' and as such, that's how we train our bots." Basically, when things get dicey, they just turn them off. I've heard that before too, but it was fun hearing it from the horse's mouth.

And, of course, that's why we have flash crashes. Also my sense is, there aren't really enough humans left to make markets in an emergency, since the profits have been all eaten up by the bots - no money to pay the human traders, which would spend 99.5% of their time sitting and looking at the bots doing their work. And the bots have only been trained on "normal situation" operations.

It makes sense. Why train a bot for exceptional situations, when a huge pile of money can be made just on the day to day fluctuations. Not only is finding enough data to train a bot to run during crash situations difficult, testing is problematic, and then of course you have to wait for a crash and see if it actually works. And if there's a bug, losses could be catastrophic. Better to pull the plug when things get iffy.

(Source)

So, why does this matter to you? Because today's "market" structure is so completely broken now that a flash crash can happen in any sector, no matter how large. That's not speculating, that's established fact.

Once a crash really gets under way, for whatever reason, getting the computer bots back online cannot be accomplished until and unless the markets are within certain operating ranges. That's just how they are built and designed. So as long as everything is within a certain set of parameters, the bots will participate. But as soon as they aren't, they'll all just disappear. When they do, they'll take literally 99% of the market quotes away and 70% of the trading volume. In an instant.

So I'll add one more 'rule' to that list above:

- No quotes + no volume = no market.

Someday parameters will be exceeded and the “"market"" will crash. Unless the central banks can manage to become such dominant buyers in the “"market"" that they become the market. Japan's central bank has already achieved this status in its country's government bonds and ETF markets.

Who knows? Maybe this is the goal of every major central bank. But if so, then we should be having a robust discussion about how this is no different than printing up money and handing it directly to the very wealthiest individuals and most powerful corporations.

That's not monetary policy. That's social engineering.

Conclusion

Patently obvious price manipulations happen daily now in all electronic markets. Oil, gold, silver, indexes, individual equities, options – you name it – all are subject to overt price manipulation tactics being run by the largest and most well-connected Wall Street and private trading firms.

The algos are now the dominant force in the markets in terms of both quote and trade volumes.

Further, the central banks can and do easily use these same lightning-fast programs to halt and reverse market price declines.

This level of micro-management of the “correct" pricing is ruining the core function of the financial markets, which is to set prices by aligning the collective needs and wisdom of millions of individuals and entities.

By ruining this, the central banks have bought some temporary market price stability at the expense of legitimate price discovery. Without that mechanism, mal-investments are now accruing, as they always do when speculation is rewarded over hard work.

Making a sound investment decision requires smarts, effort and risk. Feh! Who want's to go through all that when you can borrow at 1% and retire stock in your company yielding a 2% dividend?

Who wants to figure out how to satisfy all those state and federal regulations involved in opening a new business when you can earn more by playing the speculation game in the financial "markets"?

As my business partner Adam Taggart wrote recently:

When [the market correction eventually] happens, those who decided to look like an idiot early on and refuse to join the party (i.e., positioning their capital defensively), are going to look like geniuses. They will avoid the heartbreak of loss, and they will have capital to deploy when the dust settles, purchasing quality assets at (potentially historic) bargain prices.

It's not an easy choice to make, or to remain steadfast in. It takes foresight, courage, and resolve. But it's a smart choice.

Of course, cash savings is just one of a number of options for positioning your financial wealth defensively right now. For those looking to learn more about other ways to do so, we recommend the following progression:It's unknowable exactly how much longer our unsustainable markets can remain at their record levels. But there is one thing we know for certain: we're closer to their day of reckoning than we've been at any point over the past seven years. A recession is due soon by historical standards, and long overdue by fundamental ones.

- If you haven't yet read it, read our free report The Mother of All Financial Bubbles to understand the full nature of the situation we're living through today

- Read our report How To Hedge Against A Market Correction, to understand the most common strategies for protecting your portfolio from downside risk

- For those interested, I've shared how my own personal portfolio is positioned(Note: this is not intended as personal financial advice, but as an example to evaluate)

- Schedule a review focused on downside risk management with your financial adviser. If you're having difficulty finding one experienced on this topic, we can suggest one to consider.

When it happens, do you want to look like an idiot? Or would you rather choose to look like one now, so that you can look brilliant then?

Choose wisely.

Good luck everyone. This is the most unusual period in all of economic, financial and monetary history. Perhaps this time they've got it right.

But if not: Look out below.

USAF / Handout | Getty Images

USAF / Handout | Getty Images

Bloomberg / Contributor | Getty Images

Bloomberg / Contributor | Getty Images David McNew / Stringer | Getty Images

David McNew / Stringer | Getty Images