It's a big club and you ain't in it.

~ George Carlin

If you suspect society is unfair, that there's a different set of rules the rich live by, you're right.

I've had ample chance to witness first-hand evidence of this in my time working on Wall Street and in Silicon Valley. Simply put: our highly financialized economy is gamed to enrich those who run it, at the expense of everybody else.

The Money River

A recent experience really drove this home for me.

Having received my MBA from Stanford in the late 90s, I remain on several alumni discussion groups. Recently, a former classmate of mine, who now runs her own asset management firm, circulated her thoughts on how today's graduating students could best access an on-ramp to the 'money river'.

What's the 'money river'? Good question.

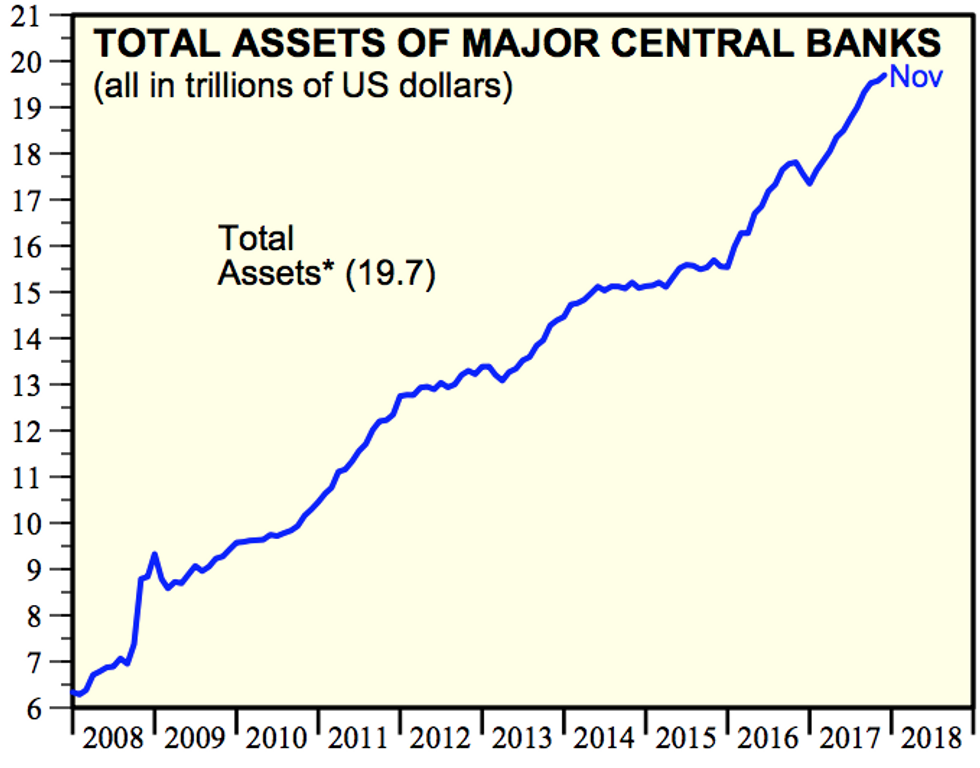

The money river is the huge tsunami of investment capital sloshing around the globe, birthed by the historically-unprecedented money printing conducted by the world's central banks over the past decade. Since 2008, they've more than tripled their collective balance sheet:

(Source)

The $13+ trillion in new thin-air money issued to achieve this is truly staggering. It's so large that the human brain really can't wrap around it. (For those who haven't seen it, watch our brief video How Much Is A Trillion? to better understand this.)

But suffice it to say, all that money has to go somewhere. And it first goes into the pockets of those with closest access to it, and of those who direct where it flows.

In the context of MBA graduates working in finance, accessing the 'money river' often follows this recipe:

- Step 1: Get hired by a buy-side fund (asset management firm, hedge fund, etc)

- Step 2: Make friends at other funds by investing part of your portfolio in their offerings

- Step 3: Leave to create your own fund, which all your new buddies will invest part of their firms' portfolios in

- Step 4: Collect a fat annual salary of 2% of assets under management (regardless of how your fund performs), plus 20% of any gains

Let's put a little math behind this, with real-world numbers based on another classmate of mine who followed this recipe. After graduating, he went to work for a prestigious private equity firm, spending nearly a decade there as a fund manager. He then left to start his own fund.

Since he had invested in scores of ventures and funds while working for the private equity firm, he had amassed plenty of industry insiders who knew they had to reciprocate when it came time for him to hang out his own shingle, because "that's how the game is played". You help me when I need it, and I'll do the same for you.

Only a few weeks after announcing the formation of his new fund, he had raised $100 million for it. At his 2% management fee, that gave him an annual salary of $2 million no matter how the fund performed. And with the standard carried interest percentage, he had substantial additional upside of 20% of any profits the fund may take in the future.

Since forming this fund nearly ten years ago, the financial markets have been on a historic bull run, with hardly any corrections along the way. This is primarily due to the trillions in new money provided by the world's central banks mentioned above. So, it's little surprise that my former classmate's fund now stands at over $1.1 billion in assets under management.

That's now a $20 million annual management fee. Plus 20% on (conservatively estimating) hundreds of millions of gains made along the way.

Not bad work if you can get it.

No Fund For You!

But that's a big part of my point here. The 99% don't have a key past the velvet rope to access the money river.

Look, I don't begrudge this guy his success. Well, maybe I do; but it's not personal -- I know him well enough to say that for certain he's extremely smart, bold and hardworking. But he's benefiting from being in the Big Club that George Carlin railed about. The rest of us ain't in that club, and won't ever be. But our futures are being determined -- or more accurately put, undermined -- by it.

All that liquidity being provided by the central banks? To keep that money flowing it needs to be cheap to those who want to borrow it, so the banks have concurrently driven interest rates down to the lowest levels in recorded history (going back over 5,000 years). Some extra-aggressive central banks have even pursed negative interest rates.

What this has resulted in is a tremendous transfer of wealth to the already-rich at the expense of everybody else.

Those with the means and access to borrow have been able to get essentially free money to do so; while savers and those dependent on fixed income have been starved of any yield whatsoever.

The wave of global stimulus plus the low cost of borrowing has driven capital into nearly every asset market, rocketing prices higher. So those who have held those assets have become substantially richer, while those who have not have become increasingly priced out.

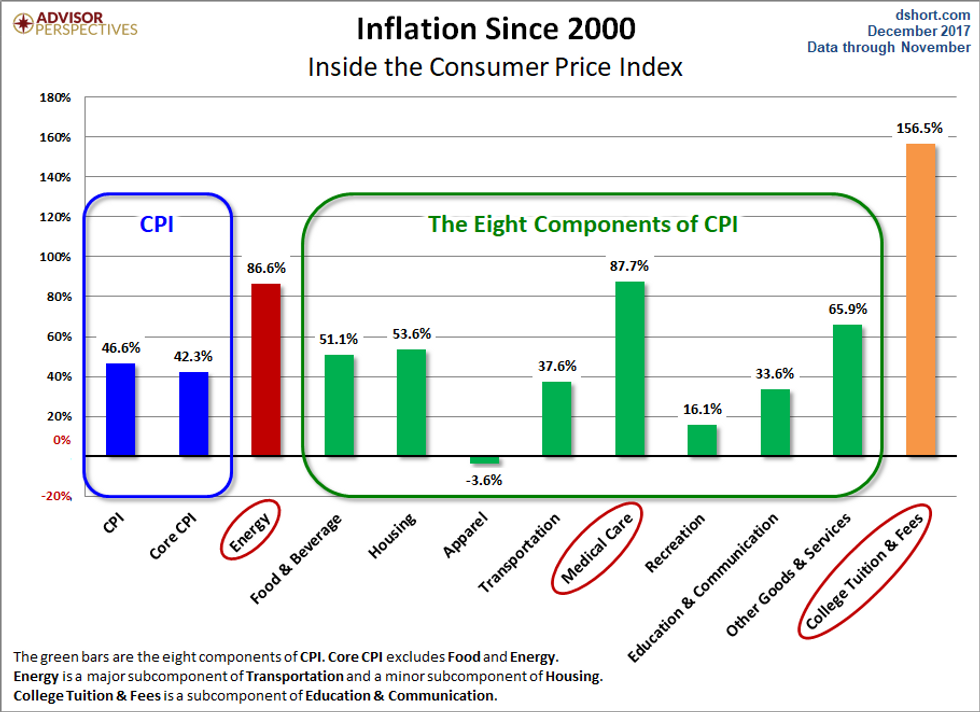

Along with asset prices, prices of nearly everything else have risen, too, dramatically increasing the cost of living:

(Source)

But, as costs have risen, wages have not. Especially when measured in real (i.e. inflation-adjusted) terms.

Real wages are now 7% lower than they were in 1973 -- and that's calculated using the official government-reported inflation rate, which we all know vastly understates the actual inflation rate. (Read our report on The Burrito Index to understand why the true price inflation households suffer is more like 5x greater than the official reported rate).

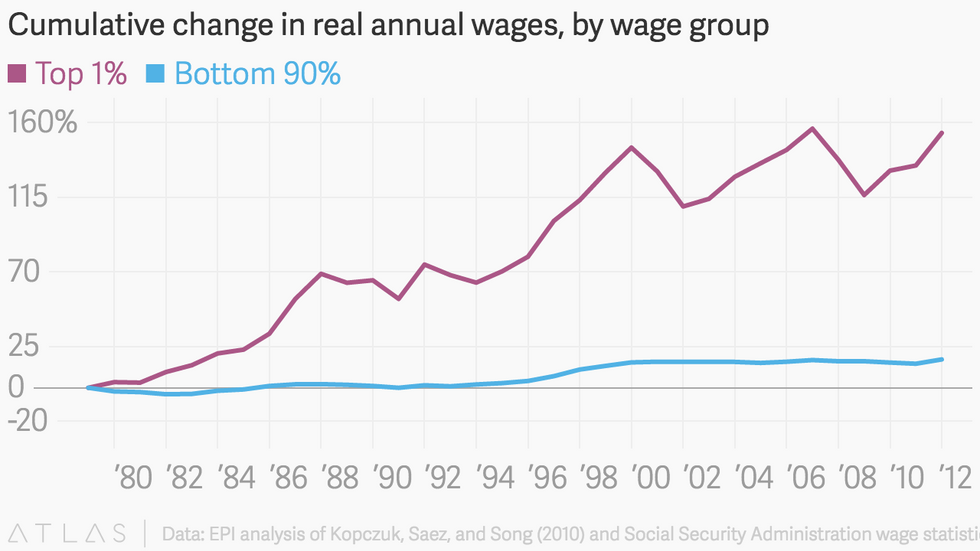

So the rich see their assets shoot the moon, and they get access to the 'money river', to boot. While the rest of us see stagnant real wages and a skyrocketing cost of living.

Is it any surprise that a tremendous and still-growing wealth gap between the 1% and everyone else has resulted?

(Source)

(Source)

The Future Looks Dim For Those Sleepwalking Into It

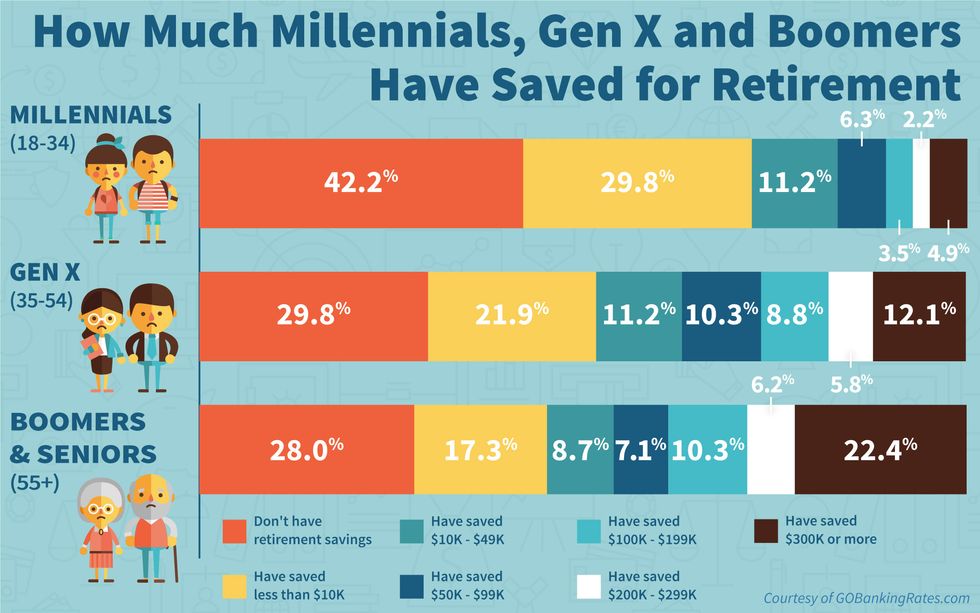

As we've written about at length in our recent report The Great Retirement Con, the average American worker is woefully unprepared to afford his/her retirement:

And for those counting on a pension, odds aren't bad it may get reduced/eliminated during a future economic crisis.

Think that could never happen? Well, Governor Jerry Brown just announced this on Wednesday:

California's Brown Raises Prospect of Pension Cuts in Downturn (Bloomberg)

California Governor Jerry Brown said legal rulings may clear the way for making cuts to public pension benefits, which would go against long-standing assumptions and potentially provide financial relief to the state and its local governments.

Brown said he has a "hunch" the courts would "modify" the so-called California rule, which holds that benefits promised to public employees can’t be rolled back.

"There is more flexibility than there is currently assumed by those who discuss the California rule,” Brown said during a briefing on the budget in Sacramento. He said that in the next recession, the governor “will have the option of considering pension cutbacks for the first time.”

That would be a major shift in California, where municipal officials have long believed they couldn’t adjust the benefits even as they struggle to cover the cost. They have raised taxes and dipped into reserves to meet rising contributions. The California Public Employees’ Retirement System, the nation’s largest public pension, has about 68 percent of assets needed to cover its liabilities.

Across the country, states and local governments have about $1.7 trillion less than what they need to cover retirement benefits -- the result of investment losses, the failure by governments to make adequate contributions and perks granted in boom times.

"In the next downturn, when things look pretty dire, that would be one of the items on the chopping block," Brown said.

And this is in California, one of the most pro-worker/pro-entitlement states in the Union. If California is already sending out warnings like this, you can be sure that the other 49 states are thinking of making (at least) equally-harsh cuts when the next recession hits.

Potential cuts to promised pensions is just one of the many ways in which those running the system will act to preserve their share of the pie when crisis next arises. Those concerned about what other measures might be taken would do well to read our report Upon The Next Crisis, The Rules Will Suddenly Change.

And for those who prefer their cynicism blended with hard truths and humor, watch this short video of George Carlin's epic rant against the elite's Big Club. I quoted Carlin at the beginning of this article for a reason, he really nailed the central point I'm trying to make (Warning: the language used gets quite graphic):

Fighting Back

So, what can the rest of us in the 99% do about it?

Is this a lost cause? Should we just accept our fate and sink to the bottom of the money river, smothered by its high prices and low yields?

No.

The good news here is that there's a clear set of strategies for keeping yourself afloat while the system continues to pursue these pernicious and deeply unfair policies. They take focus, effort and discipline -- but anyone implementing them will have good chance to stay ahead of the rising cost curve, and have a real shot at financial prosperity.

In Part 2: Winning Against The Big Club, we examine a number of strategies for offsetting the soaring costs of everything from housing to healthcare -- with particular focus on the investments and actions you can take today, inside and outside of the markets, to preserve the purchasing power of your wealth from the nefarious "stealth tax" placed on your money by the kind of inflation discussed above.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

Smith Collection/Gado / Contributor | Getty Images

Smith Collection/Gado / Contributor | Getty Images

USAF / Handout | Getty Images

USAF / Handout | Getty Images Bloomberg / Contributor | Getty Images

Bloomberg / Contributor | Getty Images